[Editor's Note: Today's WCI Network post is from Passive Income, MD, and describes a surprising number of doctors. You don't get a pass on math because you choose to live in California or Hawaii. Yes, creating additional streams of income is part of the equation for “low income” docs in a high COLA area, but you simply can't expect to keep your head above water (let alone build wealth) without cutting expenses like housing, private school, and car payments. ]

[Editor's Note: Today's WCI Network post is from Passive Income, MD, and describes a surprising number of doctors. You don't get a pass on math because you choose to live in California or Hawaii. Yes, creating additional streams of income is part of the equation for “low income” docs in a high COLA area, but you simply can't expect to keep your head above water (let alone build wealth) without cutting expenses like housing, private school, and car payments. ]

I was having a discussion with a colleague recently, and the conversation eventually turned toward finances. He informed me that if his home refinance didn’t go through, he would have difficulty in making his house payment next month. Needless to say, this was weighing heavily on his mind, and he was visibly stressed.

I sympathized with him.

It bothered me deeply that even after finishing his training and “making it” as an attending, he was still essentially living paycheck to paycheck. I thought about it for a good while, and realized I had to dig a little deeper.

After all, how is it possible that a physician making over $250,000 a year is barely scraping by, and living in fear of missing his next mortgage payment?

Assumptions

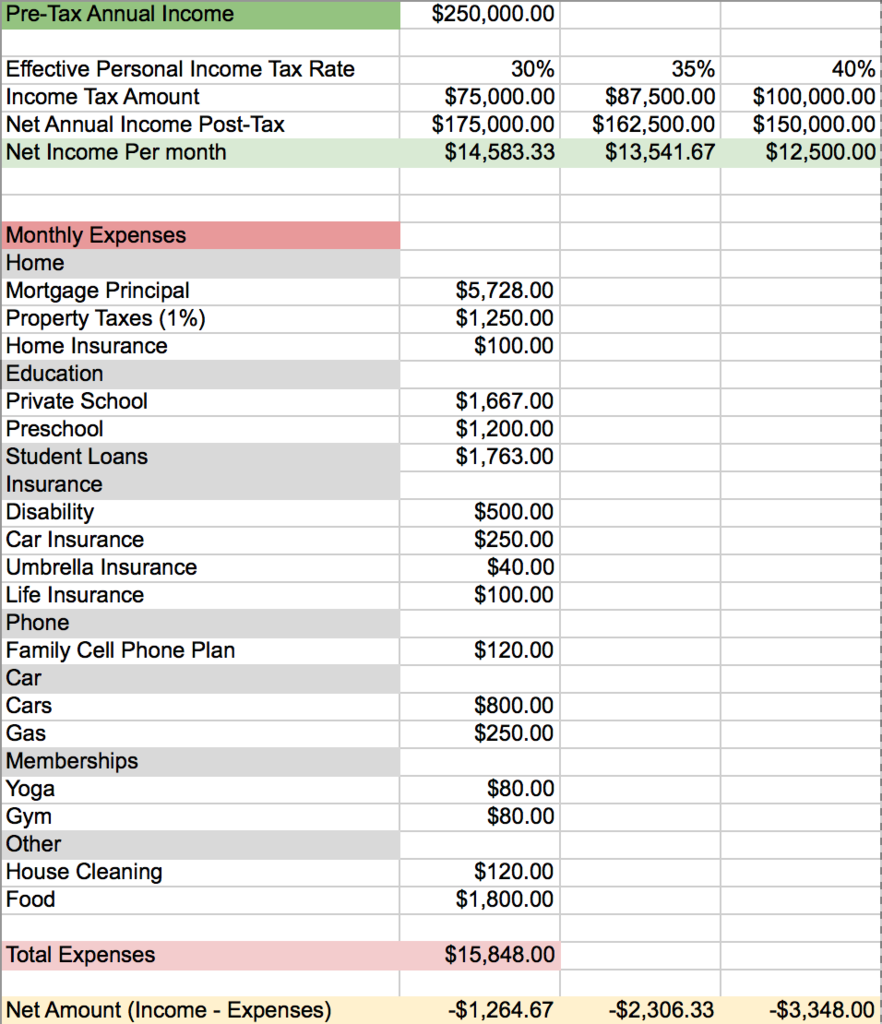

I decided to break it down on a spreadsheet and made a couple of safe assumptions for a physician working and living in Southern California. Here’s a quick key to what you’ll see:

- Our example is a family of four with one working parent (the doctor).

- Income Tax: I’ve assumed a 35% effective tax rate, but I’ll show what it would look like as a 30% or 40% effective tax rate.

- Student loans: I used the current average loan of the typical graduating medical student ($183,000), consolidated at a 10-year term, at 2.95%.

- Mortgage: I assumed a purchase price of $1.5 Million, which, unfortunately, is pretty average here in Southern California. I also assumed a 20% down payment and a standard interest rate of 4%.

- Private school average tuition is $22,000 per year or $1833.33 per month, 2nd child is in preschool.

- Food: According to the USDA, the average cost to feed a family of four is $1200/month. Living in California, the cost is easily almost double that.

I didn’t even include extra miscellaneous items such as home maintenance and upgrades, clothing, entertainment, etc.

The Spreadsheet

Here is the spreadsheet I designed to shed a little light on this predicament.

Living Paycheck to Paycheck

When it’s been broken down like this, it’s easy to see why the average doctor might be struggling to keep up, especially living in a place like Southern California. And how do most physicians make up the difference? They work harder and longer. Perhaps they pick up extra shifts. Unfortunately, this equates to simply working more just to support your current lifestyle, leaving precious little to be able to save or invest.

Surely, there must be a better way.

Well, I’ll come right out and say that a perfect solution doesn’t exist. However, it is my opinion that working harder or working more is not sustainable. This will only worsen the physician burnout epidemic.

I’ll never pretend to have all the answers. I just know that I am taking steps to avoid ending up in the same situation. Yes, one of the obvious answers is to reduce your expenses. That’s easy to suggest.

However, I want to focus just as much (if not more) on creating additional sources of passive income. The harsh reality is that we can only work so hard. Our time is both limited and precious, and it shouldn’t be spent working more, just to make ends meet.

If my colleague’s situation resonates with you for whatever reason, I encourage you to follow my journey. There’s always a better way. Let’s find it together.

What do you think about these expenses? Can you relate or not? Comment below!

The post Why Many Doctors Live Paycheck to Paycheck appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.