[Editor's Note: Today is the last day to take advantage of early bird pricing for The White Coat Investor’s newest course, Continuing Financial Education 2022. This course was created to guide WCIers on how to make wise financial decisions and to have meaningful sustainable careers, and you’ll get 50-plus hours of expert presentations while earning up to 17 CE credits! Make sure to invest in yourself by getting CFE 2022 today!]

By Dr. James M. Dahle, WCI Founder

By Dr. James M. Dahle, WCI Founder

As I've written before—both about Roth Conversions and Roth 401(k) Contributions—decisions about whether to do a Roth conversion and whether to make Roth or traditional 401(k) contributions are complex and depend, in part, on information that is unknown and even unknowable. These are complex and difficult decisions. People want a simple little calculator to help them decide, but as Einstein said, we should “make things as simple as possible, but no simpler.” There are guidelines and rules of thumb, but they have plenty of exceptions.

Today, we'll discuss 10 principles to keep in mind as you make these decisions on Roth conversions and contributions.

#1 Use Tax Rates, Not Tax Paid

The first principle addresses a common misconception—that it is better to “pay taxes on the seed than on the harvest.” The truth is that it doesn't matter whether you pay taxes on the seed or on the harvest if the tax rate is the same. Let's say you have 10 seeds and a 20% tax rate. You can pay two seeds in tax now or you can plant all 10 seeds, grow 10 trees, collect two big baskets of fruit from each tree, and then pay four baskets of fruit in tax. You end up with the same amount of fruit either way.

Paying tax on seed (i.e., Roth or tax-free)

10 seeds minus 2 seeds in tax = 8 seeds = 8 trees = 16 baskets of fruit

Paying tax on fruit (i.e., traditional or tax-deferred)

10 seeds = 10 trees = 20 baskets of fruit minus 4 baskets in tax = 16 baskets of fruit

Same, same.

#2 Fill the Tax Brackets

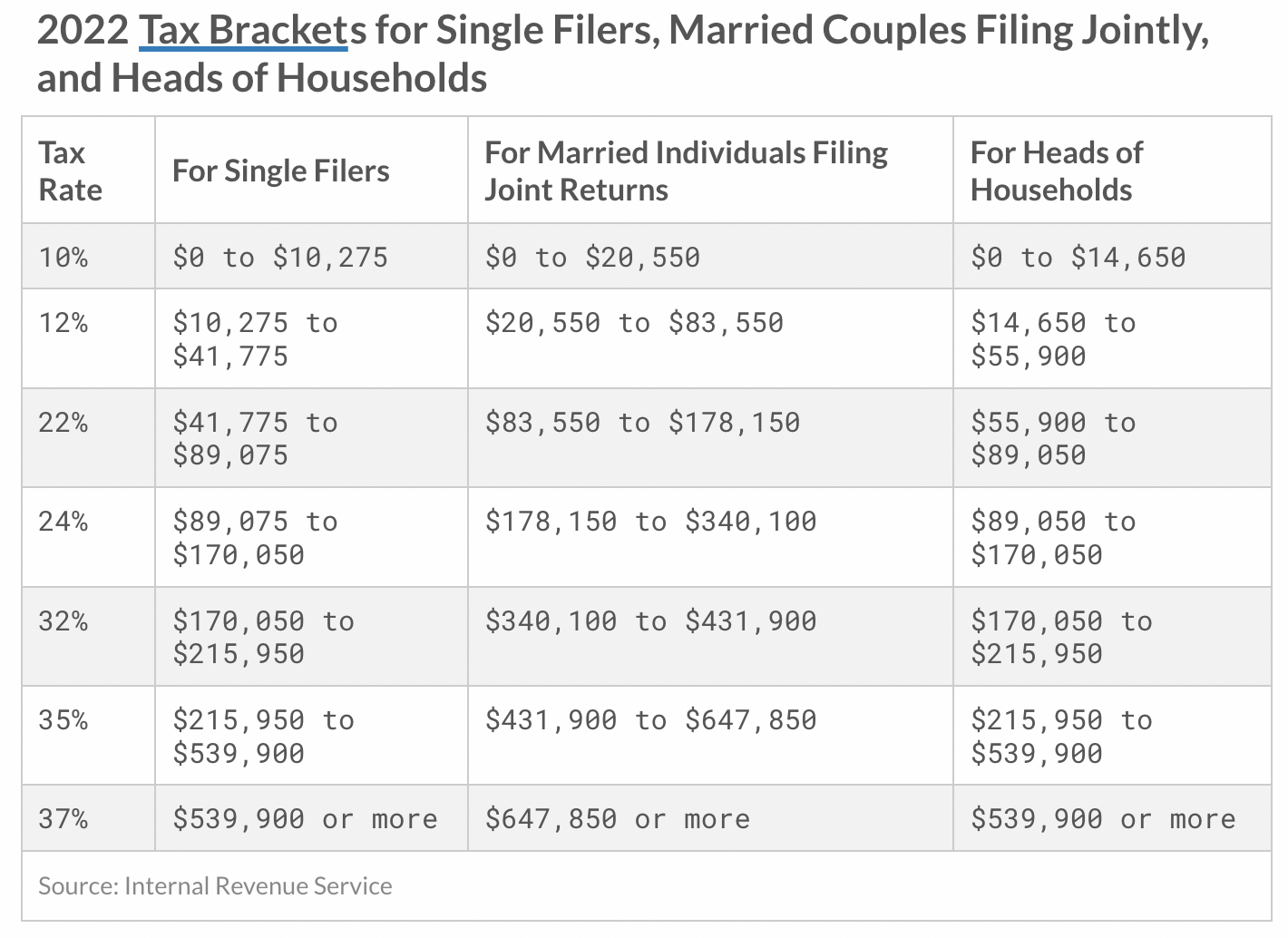

The second critical concept to understand is that you fill the tax brackets as you go. For example, when you do a Roth conversion or Roth contribution, you are generally doing that “at the margin,” often at a rate of 32%, 35%, or even 37% as a high-income professional. That means if you convert $10,000 (or choose Roth over traditional for $10,000), the tax cost of that decision is $10,000 x 37% = $3,700. If you avoid the Roth conversion (or make a traditional contribution), you save $3,700 in taxes.

However, later in retirement, you may not be withdrawing all of that tax-deferred money at 37%. In fact, if you have little or no other taxable income, you can withdraw a lot or even all of the money at dramatically lower tax percentages. Consider a 60-year-old married couple with no taxable income other than withdrawals from a tax-deferred account. Using rounded numbers, this couple can do the following:

- Withdraw $26,000 at 0% (standard deduction)

- Withdraw $20,000 at 10% (10% bracket)

- Withdraw $63,000 at 12% (12% bracket)

- Withdraw $95,000 at 22% (22% bracket)

The total tax cost of that $204,000 withdrawal = $30,460, or a rate of just 15%. I assure you that contributing at 37% and withdrawing at 15% is very much a winning strategy. Consider the following chart to demonstrate the concept.

But what if all those other brackets are filled up with other sources of income? For example, consider someone who made tax-deferred contributions at 22% and then in retirement found that they found they had the following other sources of taxable income:

- Social Security: $60,000

- Pension: $25,000

- Investment property rental income: $80,000

- Ordinary dividends and interest: $50,000

Total income, not including tax-deferred account withdrawals: $215,000

This person has filled up the 0%, 10%, 12%, and 22% brackets with other income. If they also want to take $200,000 a year out of that tax-deferred account, it will be mostly taxed at 24% with some taxed at 32%. That's not a winning strategy at all.

Note that changes in your own personal income level matter dramatically more than changes in the tax rates themselves. It really doesn't matter if the top income tax bracket rates go up by 2% or 3% if all of your withdrawals will be in the lower brackets. But a slight decrease in tax rates does matter if you saved so much money that you'll be in a higher bracket in retirement than you were during your working years.

Remember also that long-term capital gains and qualified dividends are always added to taxable income last. So, in the unusual situation where an investor has a relatively small amount of ordinary income and a relatively large amount of qualified dividends and long-term capital gains, you're dealing with a much lower tax bracket than you might imagine.

Consider a single person who is considering a Roth conversion. They are taking the standard deduction in 2022 with $54,725 of ordinary income and $500,000 in qualified dividends. The ordinary income fills the 0% bracket (standard deduction) as well as the 10% and 12% brackets. However, the Roth conversion is taxed at 22%, not 37%. Note that in this situation the additional income from a Roth conversion would also bump capital gains up from the 15% to the 20% (really 23.8%) bracket, resulting in the conversion actually costing 30.8%, not 22% or 37%. It may also affect phaseouts of deductions or credits in certain situations. It is usually easiest to do hypothetical situations like this with tax software to account for all this and to really understand the tax cost.

#3 State Tax Rates Matter, Too

You also want to consider the effect of state tax rates. If you are working in California (high tax rate) but plan to retire in Nevada or Texas (no state income tax), then deferring taxes until you are in a lower tax state makes a lot of sense. This would argue against doing a Roth conversion or Roth 401(k) contributions. Others might find themselves in the opposite situation.

#4 Favor Roth at Equal (or Similar) Tax Rates

Another important principle to understand is that you should favor Roth contributions (and conversions) if you expect to withdraw money at the same (or similar) tax rate in retirement as your marginal tax rate at the time of contribution. Why are you better off with Roth? Because when you use a Roth account, all the money is in a Roth retirement account, where growth is not taxed each year as it occurs. When you use a traditional account, some of the money is in a traditional retirement account where growth is not taxed each year as it occurs and some of the money is in a taxable account where growth IS taxed each year as it occurs—at least any growth distributed as capital gains or dividends.

Let's use an example to wrap your head around this concept using a Roth conversion (although it works similarly with 401(k) contributions). Assume you have $10,000 in a traditional IRA and $3,500 in a taxable account and that you are in the 35% tax bracket.

Roth Conversion

If you do a Roth conversion, you move the $10,000 into a Roth IRA and pay $3,500 in tax. You now have $10,000 in a Roth IRA. It grows at 8% for 30 years and you end up with $100,627 after-tax.

No Roth Conversion

If you do not do a Roth conversion, you have $10,000 in a traditional IRA and $3,500 in a taxable account. The traditional IRA grows at 8% for 30 years and you end up with $100,627 pre-tax. After paying 35% on the withdrawal, you end up with $65,407. The taxable account, meanwhile, grows at 7.6% to account for tax drag. After 30 years, it is worth $31,509. You then pay 23.8% in capital gains taxes on the growth, leaving you with $26,390 after tax. Total is $65,407 + 26,390 = $91,797.

Thus, when tax brackets are equal, you are better off with the Roth conversion or Roth contributions because more of the money enjoys tax-protected growth.

How much lower can the tax bracket be in retirement, and you still come out ahead with the Roth conversion? Well, it depends on your assumptions, especially the length of time between contribution and withdrawal (while that money is benefitting from tax-protected growth). But with our 30-year example, the break-even difference in tax rate is about 9%, i.e., even if you paid 35% on the conversion and later took out the money at an average tax rate of 26%, you would still break even.

#5 Pay for Conversions with Taxable Money Whenever Possible

The above example illustrates the importance of paying for a Roth conversion with taxable money (and preferable without incurring any capital gains taxes to access it) rather than tax-deferred money. Without that factor, it makes less sense to do a Roth conversion at all.

Again, consider a Roth conversion, but use the tax-deferred account to pay for the tax bill.

No Roth Conversion

If you do not do a Roth conversion, you have $10,000 in a traditional IRA. It grows at 8% for 30 years and you end up with $100,627 pre-tax. After paying 35% on the withdrawal, you end up with $65,407.

Roth Conversion

Now, let's say you want to do that Roth conversion, but the only money to pay the tax must come out of the traditional IRA itself. How much can you convert? Well, you have to pull out the 35% to pay the tax bill plus you have to pull out the 10% penalty for the early withdrawal. After a little algebra, X + 0.35X + 0.1 * 0.35X + 0.1 * 0.1 * 0.35X + 0.1 * 0.1 * 0.1 * 0.35X = $10,000 which simplifies to about 1.39X = $10,000, you find that you can convert $7,194. You'll end up paying $2,806 in tax and early withdrawal penalties. After 30 years, that $7,194 grows to $72,391. You (perhaps surprisingly) are still coming out ahead for doing the Roth conversion. But it does not take as large of a tax arbitrage to eliminate that benefit. If you could have withdrawn at an average rate of just 28% (instead of 26% if you had paid taxes from outside the account), you would come out even.

If accessing that taxable money will require paying taxes you otherwise would not have to pay, that could eliminate this benefit. Honestly, though, this issue is not as big of a deal as I thought it was until I ran the numbers. Most of the time, if a Roth conversion makes sense when paid for with taxable money, it will still make sense if paid for with tax-deferred money, especially after age 59 1/2 when the 10% penalty goes away.

#6 Who Will Spend the Money?

Another really important factor comes down to who will spend the money. As mentioned in point #1, it's really all about the comparison of the tax rate at contribution to the tax rate at withdrawal. But so far, we've been assuming YOU will be the one paying the taxes at withdrawal. There are several other options that could occur:

- Your heir, in a much higher tax bracket, pays the taxes

- Your heir, in a much lower tax bracket, pays the taxes

- A charity “pays” the taxes (i.e., no taxes are paid)

In the first scenario, that Roth conversion is going to work out very well in terms of the overall tax burden. In the second, the Roth conversion will not work out very well at all. In the third scenario, the Roth conversion would be a disaster since the charity would not pay any taxes at all if left tax-deferred money. If you will be leaving money to charity, it makes a lot of sense to preferentially leave tax-deferred money.

Since Katie and I plan to leave a substantial portion of our estate to charity (a larger amount than we will ever have in tax-deferred accounts), Roth conversions (and contributions) really don't make any sense at all for us from a tax standpoint alone.

However, there are additional benefits to Roth conversions besides just being a tax arbitrage. In most states, IRAs, including Roth IRAs, receive substantial asset protection, so when you “move money into” retirement accounts by paying the tax on a Roth conversion, more of your money is protected from your creditors by your state exemption. Retirement accounts also pass outside of probate thanks to the ability to name beneficiaries. In addition, if you are wealthy enough to have an estate tax problem, Roth conversions help reduce the size of your estate subject to estate taxes.

#7 Roth Conversions Reduce RMDs

Starting at age 72, investors must begin withdrawals from their traditional IRAs and 401(k)s (including Roth 401(k)s). These are Required Minimum Distributions (RMDs), and there are huge penalties for not taking them (50% of what you should have taken out). Even if you don't want or need the money, you must remove it from the IRA and reinvest it in a non-qualified/brokerage/taxable account. When you do a Roth conversion (at least into a Roth IRA), RMDs are no longer required, and that money can continue to grow tax-free for you and/or your heirs.

#8 Split the Difference?

Some people just aren't sure what to do when it comes to Roth vs. traditional 401(k) contributions or doing a Roth conversion. However, this is not an either/or decision. You can always split the difference, making half your contribution tax-deferred and half tax-free (or doing half of your potential Roth conversion). The upside is that you know you will have done the right thing with half your money. The downside? You also know you will have done the wrong thing with the other half.

Personally, I prefer trying to guess which is right and just doing that, but I'd be a liar if I said I had never guessed wrong. Those tax-deferred Thrift Savings Plan contributions I made at 15% while I was in the military look downright stupid now that I expect to spend the rest of my life in the top tax bracket. To be fair, there was no Roth option, but in retrospect, I still should have converted it all to a Roth IRA the year I left the military.

Likewise, the Roth 401(k) contributions and Mega Backdoor Roth IRA contributions we've been doing the last couple of years might also have been “wrong” given our estate planning goals that we've more recently determined. This stuff is complex, so I don't blame anyone for just splitting the difference.

#9 Convert to the Top of a Tax Bracket

When doing a Roth conversion, you generally want to convert “up to the top of a tax bracket.” That is, if it makes sense to do a Roth conversion at 24%, you should convert as many dollars as you can at 24%. This obviously requires you to be reasonably accurate at projecting your taxable income for the year, but hopefully, you can do that to within a few thousand dollars by November or December. If your estimated taxable income was $250,000 (Married Filing Jointly, 2022), you could convert $90,000 at 24% but any additional conversion would be done at 32%.

#10 Conversions Are Even Better in a Bear Market

Bear markets are nobody's favorite, but they do present opportunities such as “buying low” and tax loss harvesting. Roth conversions are another bear market opportunity. If you have a $100,000 IRA all invested in stock index funds and the market tanks 30%, you now have a $70,000 IRA. Converting it to a Roth IRA at 24% now only costs $70,000 * 24% = $16,800 instead of $100,000 * 24% = $24,000. You've just saved $7,200 in taxes just for timing your Roth conversion well.

Should YOU Do Roth Contributions (or a Roth Conversion)?

Here is where the rubber meets the road. The answer—like most things in law, accounting, and finance—is that it depends. It depends on many factors, some of which you know, some of which you don't know, and some of which you cannot know. These include:

- How long you will work

- How long you will live

- How much you will spend in retirement

- How much money you will have in retirement

- What types of income you will have in retirement

- Who you leave your money to

- The tax brackets of your heirs

- Whether your heirs will stretch an inherited IRA for 10 years

- Whether the government changes tax rates and in which direction

See what I mean? It's complicated. If you want to try to figure it out for yourself, the best place to start is to estimate how much taxable income you will have in retirement and see which brackets that income is likely to fill. Then, compare your marginal tax rate in retirement to your marginal tax rate now, recognizing that if it is close, it favors Roth contributions/conversions.

However, when things get complex, most people prefer to use rules of thumb. They're quick and easy and work most of the time.

Rules of Thumb for Roth Contributions and Conversions

Let me go over a few of these. Note that all of these have exceptions, so don't nitpick me. They work most of the time.

#1 Peak Earning Years = Tax-Deferred

This is the rule of thumb I've been using for years. The typical high-income professionals that are the target audience of this blog are in the 24%, 32%, 35%, or 37% brackets during their peak earning years. Most of them are married and retire on Social Security (perhaps $40,000-$60,000 per year) and with a nest egg of $2 million-$5 million, mostly in tax-deferred accounts. In that situation, their typical retirement taxable income is between $100,000-$220,000, basically the 22% bracket. So if they do tax-deferred contributions and save 32%, 35%, and 37% during their peak earning years and then mostly withdraw that money at 12% and 22% (0%, 10%, 12%, and 22% prior to taking Social Security), they're going to come out way ahead.

The reverse of this rule of thumb is also true. In any year when you are not at your peak earnings such as:

- Medical school

- Residency

- Fellowship

- The year you leave training

- A year with extended parental leave

- Sabbatical

- Part-time work

it makes sense to make Roth 401(k) contributions and also do some Roth conversions. The main exception? Going for Public Service Loan Forgiveness (PSLF). Tax-deferred contributions in that situation result in a lower taxable income, lower IDR payments, better cash flow, and more forgiven via PSLF.

#2 High Retirement Income Earners Should Favor Roth

If you expect to have a very high taxable income in retirement, you should (almost) always favor Roth contributions/conversions. Basically, if you will have enough taxable income from any source (except qualified dividends/long-term capital gains) to put yourself into the top three brackets (32%, 35%, or 37%) in retirement, you should (almost) always use Roth accounts preferentially—even if you are paying 37% on the contribution/conversion. The 32% bracket currently [2022] starts at $340,100 married but just $170,050 if you are single. And remember that unless you die the same year your spouse does, one of you will be single at least for a while. Sources of taxable income in retirement include:

- Social Security (85% of it will be taxable for most of this blog's audience)

- Pensions

- Tax-deferred withdrawals

- Interest

- Ordinary dividends

- Real estate rents not covered by depreciation

If you will have $182,000-$364,000 (top of 24% bracket + standard deduction) of taxable income from these sources in retirement, favor Roth.

#3 Supersavers Should Favor Roth

A major exception to the “tax-deferred in peak earning years” rule of thumb is a supersaver. If you save so much of your money that you are likely to be in a higher tax bracket in retirement than you are in your peak earnings years, then it makes sense to favor Roth contributions/conversions even in your peak earning years. This can be more a reflection of career length than of savings rate, however. Note that this also requires a somewhat tax-inefficient retirement income strategy. If your income is going to be predominantly qualified dividends, long-term capital gains, and basis, even a supersaver may still be better off with tax-deferred contributions during peak earning years.

#4 Very Charitable Folks Should Favor Tax-Deferred

The more you will give to charity during your retirement years and at your death, the more you should favor tax-deferred. If you will be giving more to charity than you have in your tax-deferred accounts—and especially if you are not going to be paying estate tax—there is no reason to do Roth conversions or contributions. You will leave more to charity/heirs by not going down the Roth route.

Roth conversions and contributions have lots of advantages. These include investment, tax, estate planning, and asset protection advantages. If you are afraid of high RMDs, the solution is not to avoid retirement accounts but to make Roth contributions and conversions. Nearly every white coat investor should seriously consider both Roth conversions and Roth 401(k) contributions (in addition to Backdoor Roth IRA contributions) at certain points of their lives, particularly any year that is not a peak earning year.

What do you think? Are you doing Roth conversions and/or Roth 401(k) contributions? Why or why not? Comment below!

The post Roth Conversions and Contributions: 10 Principles to Understand appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.