[Editor's Note: Many of you know all about DLP Capital Partners and its fantastic real estate funds. Now, the real estate investment group is offering our readers two new funds, a preferred credit fund AND a ground-up building fund. DLP has long been a preferred partner of The White Coat Investor, and it treats investors better than any similar company we know with investments that are straightforward, easy to understand, and profitable. Click here to learn more and get started today!]

By Dr. James M. Dahle, WCI Founder

By Dr. James M. Dahle, WCI Founder

If your career goals entail working for a qualifying employer (military, VA, academia, CHC, direct employment by a non-profit hospital) and you made a significant number of IDR payments during your training, PSLF is pretty much a no-brainer for anyone with a large number of student loans.

However, if you are only considering working for a qualifying employer due to the possibility of PSLF, then you need to compare the salaries. If the after-tax salary from the non-qualifying job is GREATER than the after-tax salary from the qualifying job PLUS the amount of potential forgiveness under PSLF divided by the number of years you must work at that job to get PSLF, THEN you should simply go work at the for-profit job, refinance your loans, and pay them off in 2-5 years by living like a resident. If that is not the case and you don't mind working for a qualifying employer, then you should take the qualifying job. Many times, the salary at a non-profit isn't even less than that at a for-profit job (though most of the time, it is).

Should You Go for PSLF as an Attending?

As a general rule, the real secret to having a ton of money forgiven via Public Service Loan Forgiveness (PSLF) is to make a ton of tiny Income-Driven Repayment payments during a long residency/fellowship training period. At the median physician income ($275,000) and the median physician debt load ($200,000), it is probably still good advice to not go for PSLF if you made the mistake of deferring your student loans during residency.

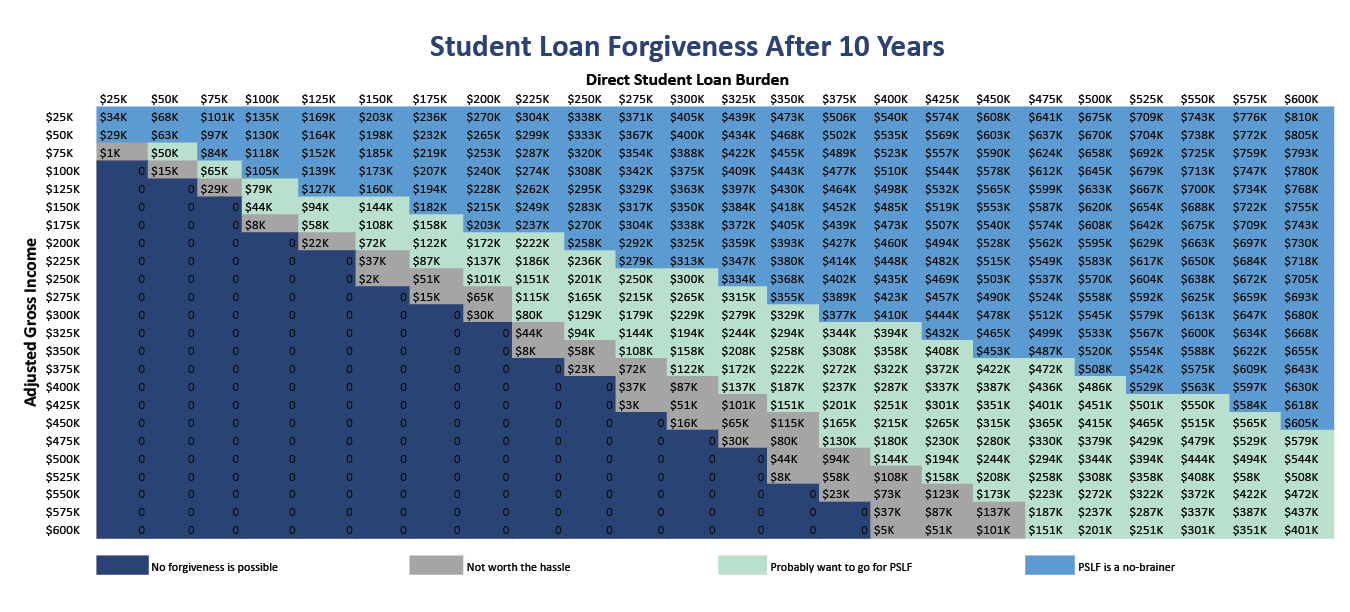

However, if you actually run the numbers, you will see that at the higher debt to income ratios, that advice does not hold at all. I went through the trouble of actually running the numbers a few years ago, and after a couple of hours with a spreadsheet, I think I am now in a position to provide some better direction for those of you who deferred in training.

The bottom line is that every doctor needs to run this calculation for themselves. There are a lot of variables, so there will always be at least a little bit of guesswork. There is also the risk that the programs (IDR forgiveness and PSLF) will be modified (which is what happened in October 2021 when the Department of Education said any payments you made in the past via the FFEL program will count toward PSLF if AND ONLY IF you consolidate your loans by Halloween 2022). The programs could also be means-tested or eliminated without grandfathering provisions.

Otherwise, here are the general rules for IDR forgiveness and PSLF:

- If you can qualify for PSLF by working at a 501(c)(3), you should go for it.

- If you have a large student loan burden (debt-to-income (DTI) ratio of 1.5+) and you are not an incredibly highly paid specialist, you should give very serious consideration (i.e. make some careful calculations using reasonable assumptions) to making PAYE payments for 20 years (or even REPAYE payments for 25 years). But realize that you are swapping lower loan payments for a high tax bill balloon payment, so be sure to include that in your calculations. If your DTI ratio is terrible (2.5+), then you should definitely look into IDR forgiveness.

If you are relatively average (or better) in loan burden and salary, then refinance your loans upon residency graduation and live like a resident until they're gone.

PSLF for Doctors Who Deferred in Residency

What should docs who deferred their student loans in residency do? Should they go for PSLF, or should they refinance and get busy paying them off? Well, if they're working for a qualifying employer, have a moderate DTI ratio (1X+), and run the numbers carefully, they will likely find that they should still go for PSLF.

Before we get into the spreadsheet, let's talk about the assumptions that went into it.

- The X-axis is Direct Student Loan Amount upon entering into the program. If the loans aren't DIRECT federal student loans, they don't qualify for PSLF. You might as well refinance those medical school loans and get busy paying them.

- The Y-axis is your adjusted gross income. That's line 7 on the new 1040. It is NOT your gross salary or your total income. What deductions live between your gross income and your adjusted gross income? The main ones for docs are retirement account contributions, HSA contributions, and health insurance premiums. So maxing those things out can reduce your adjusted gross income, reduce your required IDR payments, and increase the amount forgiven via PSLF.

- In my example, I used an average student loan interest rate of 7%. I also assumed the doctor's income remained steady over the 10-year period. I used a married couple with two kids (i.e. a family of 4). If you don't like my assumptions, use your own.

- I used REPAYE as my IDR. It is the most common program used because of the interest rate subsidy it provides. However, it has a big disadvantage compared to IBR and PAYE—the payments aren't capped at the 10-year standard repayment amount. So at a low DTI ratio, you could pay less and get more forgiven if you enroll in PAYE instead. PAYE often results in a larger amount forgiven, but that is simply because there is no interest rate subsidy which really doesn't matter for those who actually get PSLF.

- The usual caveats for PSLF apply: it exists at the whims of Congress. In the past, both political parties have made proposals to limit it enough that it would become useless for most docs, but those currently in the program would likely be grandfathered in to any changes. You should also keep careful records of your annual employer certifications and every single qualifying payment, and you should build a PSLF Side Fund just in case.

- The IDR programs have their own forgiveness feature that does not require full-time or nonprofit work. However, that forgiveness is taxable and requires 20-25 years of payments, making it much less attractive except at high DTI ratios (1.5-2.5+).

- Remember how your monthly payments are calculated under REPAYE. You subtract 150% of the poverty line in your area from your adjusted gross income and divide by 12. If that payment does not cover all of the interest that accrued that month ($1,000/month for a 6% $200,000 loan), then half of the remaining interest is forgiven each month.

Let's start at the extremes. Starting in the upper left corner, we see someone with an AGI of $25,000 and a student loan burden of $25,000. After 10 years of payments, that person would have $34,000 left on their loans. That means they weren't even covering the interest on their payments, and despite the REPAYE subsidy, the loans still grew by $9,000 over those ten years.

Moving to the upper right corner, we see someone with an income of $25,000 and a loan burden of $600,000. Did I mention we're talking about extremes here? This person will make tiny little payments for a decade (actually the payments will all be $0) and then have $810,000 forgiven tax-free. Pretty nice benefit for working for a non-profit. It basically quadrupled your income.

In the lower left corner, we see someone with an income of $600,000 and a debt of $25,000. This debt will be paid off long before 10 years under REPAYE and in exactly 10 years in PAYE and IBR, so there will be nothing left to forgive.

The final extreme, the lower right corner, is where things get interesting. This is a doctor with an income of $600,000 and a debt burden of $600,000. If you run the numbers, this doctor will pay $4,693/month for 10 years, a total of $559,000 and THEN have the remaining $401,000 forgiven. Not too bad for a DTI that isn't even particularly high (1X).

Color Codes

As you move around the chart, you will see that I have color-coded it into four colors.

Dark Blue

You will see that no forgiveness is possible. If you are in this area, you might as well refinance and get a better interest rate to help you pay off your loans faster.

Grey

In the grey area, it is technically possible for you to receive forgiveness, but I don't think it's worth the hassle. You're still going to pay off most of your loans and the amount you're going to have forgiven is less than 1/4 of your annual salary. For example, consider someone with an AGI of $300,000 and a loan burden of $200,000. You could technically get $65,000 forgiven. But that's really only $6,500 per year, about 2% of your income. And you already paid $258,000 toward your loans! You could probably pay less interest overall by just refinancing, lowering your interest rate by a couple of points, and paying that loan off quickly. I don't think that's enough money to be worth the pain of dealing with Fedloans for 10 years, keeping track of all your payments and certifications, and trying to get the government to do what it agreed to do.

Light Blue

The light blue area is where PSLF is a no-brainer. These folks are going to have MORE forgiven than they borrowed. It doesn't matter so much if they're in PAYE or REPAYE, file MFJ or MFS, or contribute to Roth or tax-deferred accounts. Getting this PSLF is a critical part of their financial plan. Consider a pediatrician making $150,000 with $600,000 in student loans. This doc makes payments of $943 a month for 10 years, a total of $109,000, and then has $755,000 forgiven. Basically, PSLF wiped out 5/6ths of her $600,000 loan.

Light Green

The light green zone is an area where people also probably want to go for PSLF, although their payments will cover more than their interest and they won't receive any REPAYE subsidy. Using all the tricks (PAYE + MFS and maxing out tax-deferred accounts) to get that AGI down can really make a difference here in how much is left to be forgiven.

What surprised me when I ran these numbers was that this light green zone lives in the 1X debt-to-income ratio. For some reason, I thought when I had run the numbers in the past that it lived at a much higher DTI ratio. Consider a doc who makes $300,000 and owes $300,000. This doctor will make payments of $2,193 for a total of $259,000 and then have $229,000 forgiven. That's like getting a raise of $23,000 a year, about 10% after taxes.

I chopped the chart down a bit to demonstrate the range of typical physician incomes ($150,000-$400,000) and debt burdens ($100,000-$400,000). Again, you can click on it to make it bigger.

As you can see, the biggest swath is in the light green zone. There are lots of doctors who, despite making a terrible error by deferring their student loans during residency, should still go for PSLF if they want to work at a 501(c)(3).

Bottom line? From now on, I'm going to have to say you should run the numbers when it comes to deciding if you should go for PSLF or not. However, if you're in the dark blue or grey zone, check out the rates and cashback you can get by refinancing through the links in this chart:

† Bonus includes cash rebates and value of free course. Borrowers who refinance more than $60,000 in student loans using the WCI links will be enrolled in The White Coat Investor’s flagship course, Fire Your Financial Advisor for free ($799 value). Borrowers will still receive the amazing cash rebates that WCI has negotiated with each lender. Offer valid for loan applications submitted from May 1, 2021 through January 31, 2022. Free course must be claimed within 90 days of loan disbursement. To claim free course enrollment, visit https://www.whitecoatinvestor.com/RefiBonus.

Student Loan Refinancing Disclosures

What do you think? Did you defer in residency? Are you going for PSLF? Where do you find yourself on the chart above? Comment below!

[This updated post was originally published in 2019.]

The post Is Public Service Loan Forgiveness Worth It for Doctors? appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.